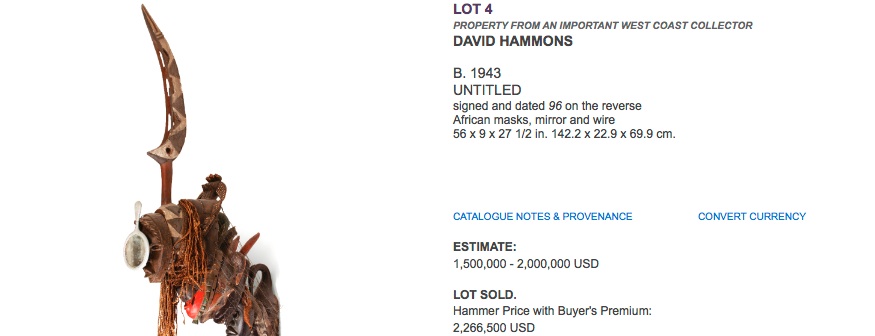

Hammons Lot 4 at Sotheby's Nov. 9 brought $2.266m

“Consumer Grade” Art Moves on eBay – Says Skates Global Art

While European Union leaders meet in Brussels today on bulwarking “a firewall” to the eurozone crisis, Skate’s Global Art Industry Art Investment Review released December 23 reports that the art market in 2012 will “decompose into Investment and Consumer grades. (“Decompose?”) “Art securitization and e-commerce to drive growth for these market segments, respectively.”

The respective contrast between “grades” deals in the gulfs that are seen between auction prices, and on e-commerce channels. We’ve reported on art investment grades’ apotheosis moments. November 9, Sotheby’s Clyfford Still for $61 million; also David Hammons Lot 4 for $2,266,500. (Hammons, for whom dematerialization was the real deal, in an early performance sold snowballs on New York City sidewalks.)

Skate’s thinks investment grade art is maxing out. Straitened money from tech and emerging market pipelines, will saturate the art market at a trading volume of $100 billion per annum, “Skate’s believes.”

“As buying and selling art becomes less and less akin to entering a temple and hearing from the gods, the entire (art) industry will have to reform to meet new consumer patterns.”

The result rides in a “consumer product vertical” of websites led, yes, by eBay in first place of 30 places Skate’s has assigned to e-platforms deemed tech and audience-ready for consumer grade art sales.

eBay has capitalization (and thou, Art.sy?) of $39.59 billion, “which is 33% more than the total value of the world’s Top 5000 masterpieces by auction prices.” Collectibles and art is its fourth most popular category already (after fashion, electronics and motors.)

On the top 30 list liveauctioneers comes in second, and artnet at third. Christie’s is four, Sotheby’s 7, Saatchi Online (which has linked us in the past) 9. Gagosian’s at 12, and Art.sy, still in beta (development), at 16. Part of what will be worth watching is how consumer patterns will price-inform in possibly riotous ways. Can one imagine a future “spot” market in Damien Hirst as rumors of auction are supported with a bevy of postmodern repro men selling spotted pencils or mousepads online?

Skate’s sees the technical prowess of eBay as unbeatable: platform and people already together online.

What else can be read between the lines of this report – after the baseline conclusion that “investment” grade finds high-end dealers needing to focus on the hold and the buzz-build until fever pitch and gavel fever correlate – is that there is going to be a lot of room for penetration into the “vertical.”

As, you just never plain know when “consumer grade” will veer over into investment grade, truly. David Hammons’ de-materialization of yore, which (speaking of snowballs), is just an excuse to cite Idler magazine and the Practical Home Onanist July 1993 column. “The ‘second bitterness equation,’ subtitled “Not in the Right (Fucking) Place at the Right Time (Was I)?”

(Idler 1993: “Greece is an idler’s spiritual home.”)

Marketwatch reported Sunday from Davos that buzzword of the World Economic Forum was “firewall.” For investment grade’s sake.